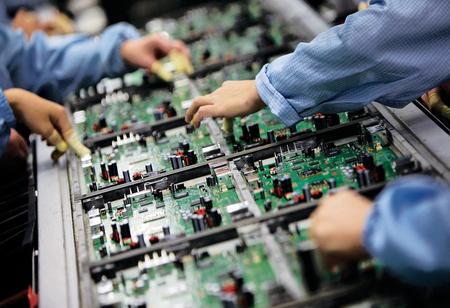

Since the Indian government recommences its thrust on domestic electronics manufacturing with various incentive-linked schemes, the country has a great opportunity as well as needed capabilities to set up a full-fledged semiconductor fabrication (FAB) electronics manufacturing ecosystem in the country, the India Cellular and Electronics Association (ICEA) said on Wednesday.

India's share in the global electronics manufacturing has matured from 1.3 per cent in 2012 to 3.6 per cent in 2019. Domestic electronics manufacturing has set up substantially from Rs 1.90 lakh crore in 2014-15 to Rs 5.34 lakh crore in 2019-20, growing at a compounded annual growth rate of 23 per cent.

Though, there is still a lot to be done in this region. As per estimates of ELCINA, the electronic components manufacturing segment suffers from a disability of around 10 per cent because of the shortage of adequate infrastructure, domestic supply chain and logistics constraints, high cost of finance, inadequate availability of quality power, limited design capabilities and focus on R&D by the industry apart from inadequacies in skill development.

"We are looking at building a large electronics manufacturing ecosystem in India and it's certainly never late to start. Hence, FAB can be a steppingstone to make India the global electronics manufacturing hub of the world. It will also be in line for achieving the NPE 2019 target of $400 billions of domestic manufacturing and export

of electronics,"stated Pankaj Mohindroo, Chairman, ICEA.

Consequently, "a production of one billion mobile handsets is targeted by 2025, valued at $190 billion, including 600 million mobile handsets valued at $110 billion for export. Therefore, India has the opportunity and the capability to establish a full-fledged FAB electronics manufacturing ecosystem in the country," Mohindroo said in a statement.

In April 2020, the government declared a Rs 41,000-crore Production Linked Incentive (PLI) scheme for manufacture of electronics in India. More lately, the scheme was extended to IT hardware with an outlay of Rs 7,350 crore.

In an effort to incentivise the electronics segment further, the government had appeared with an Expression of Interest (EOI) for establishing of semiconductor wafer or device fabrication facilities in India or acquisition of semiconductor FABs outside India.

India's display panel market is estimated to be of around $7 billion and is likely to raise to $15 billion in just four years, by 2025.

Nevertheless, setting up a display FAB manufacture unit is an extremely capital-intensive project and needs an estimated investment of around Rs 70,000-75,000 crore or roughly $10 billion over a period of 2-3 years.

"FAB manufacturing facility is a capital-intensive business, and it is present in very few geographies of the world. Hence, we should build a competitive environment. We need to be very aggressive in terms of providing proper infrastructure facilities such as water, power, and logistics apart from capital support," Mohindroo claimed.

A start has already been made in domestic display FAB manufacturing as South Korean electronics giant Samsung has already made an investment of Rs 4,825 crore for assembling displays in India.

As per Aruna Sharma, a practicing growth economist and former secretary, ministry of electronics and IT (MeitY), it is natural to move from just assembly to that of display FAB manufactured indigenously in the country.

"The intention to get into display FAB manufacture is seen by investments by Samsung and MeitYs' call on EoI. A plant can be set up in 2-3 years, thus giving advantage of not just reducing imports of parts considerably but also enable India to become a hub for exports of displays," Sharma added.