India imposed mining fees for three essential minerals, including lithium, that are essential to achieving its goals for renewable energy. The London Metal Exchange (LME) will set the royalty rates for lithium extraction by mining companies at 3% of those prices.

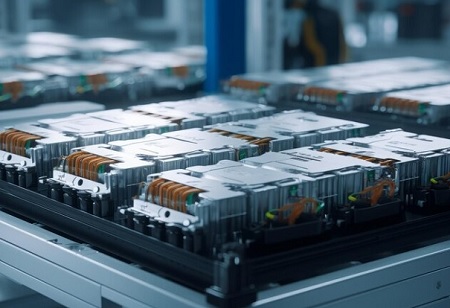

Lithium is a crucial raw material used to produce electric car batteries, and India has been looking for ways to secure supply of this material. In February, it discovered its first lithium resources in the federally controlled territory of Jammu & Kashmir. The government also fixed the mining royalties for rare earth elements (REEs) at 1% of the average sale price of rare earth oxide and 3% of the average sale price for niobium. Batteries for electric vehicles also contain niobium.

The clearance will open the door for the nation's first sale of mining blocks for the three minerals. "Critical minerals have become essential for economic development and national security in the country" .

"Critical minerals such as Lithium and REEs have gained significance in view of India's commitment towards energy transition and achieving net-zero emission by 2070." India intended to set the extraction-related royalty rate at 3% in June. Later this year, India is anticipated to auction off the freshly discovered lithium blocks, which are thought to contain 5.9 million tonnes of reserves.

Adani Enterprises, Vedanta Ltd, Reliance Industries, Jindal Steel and Power Ltd, Himadri Chemicals, and Korea's LX International are just a few of the domestic and international businesses that are likely to participate in the auction. A effort by large economies to secure lithium supplies coincides with plans to auction off India's lithium reserve. A new alliance between the US, Canada, and other nations has been formed with the goal of assuring the supply of vital minerals, such as lithium.

We use cookies to ensure you get the best experience on our website. Read more...