Crowdfunding is a way of raising money that has gained quite a popularity over the last few years. It saw a sudden increase when people started donations through crowdfunding platforms during COVID. In most cases, crowdfunding is done through online platforms that act as an intermediary between the receiving and giving parties. There are many crowdfunding platforms in India, but not many know about the tax implications associated with it, especially at the time of ITR filing

Crowdfunding is controlled and regulated by the Securities and Exchange Board of India (SEBI). Funders and donors should be aware of the tax implications related to crowdfunding. These can be classified under two main categories:

● Taxes on money received through crowdfunding platforms. ● Laws around FCRA (Foreign Contribution Regulations Act) donations.

Taxes on Money Received Through Crowdfunding Platforms

Do you know when there is a fundraising campaign organized for a cause, the most amount goes towards paying the taxes and not the cause? Let’s help you with an example. Rana Ayyub is an Indian journalist who chose crowdfunding to help people impacted by COVID-19 in India. She raised INR 2.7 crores of which INR 90 lakhs went towards government taxes.

So, all the individual fundraisers who collect money in their accounts have to pay income tax on the same while ITR filing. In addition, they can also face financial scrutiny from the Income Tax department for receiving money in the account.

Once the fundraiser transfers the amount to the recipient for whom the campaign was launched, they will also pay income tax on the money received. Hence, the total donation is subject to double donations.

Different Scenarios for Tax Implications Through Crowdfunding

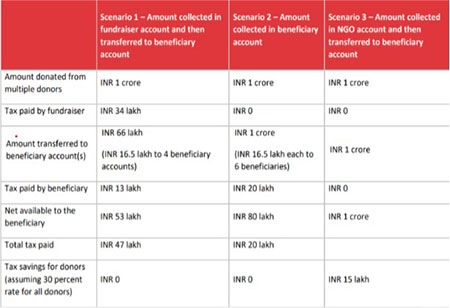

Crowdfunding is a difficult concept to understand, especially for ITR filing purposes. In case you feel you are unable to connect the dots, it is better to speak with an online tax consultant and understand the process. Below are different scenarios through which crowdfunding is done and the tax implications for donors and fundraisers.

The above chart explains in simple terms that scenario 1 is the worst to raise crowdfunding since the total amount received for the cause will be way less than what is actually donated. Similarly, people can still get more money than in scenario 1 in the case of scenario two as only the beneficiary will have to pay and not the donors.

The above chart explains in simple terms that scenario 1 is the worst to raise crowdfunding since the total amount received for the cause will be way less than what is actually donated. Similarly, people can still get more money than in scenario 1 in the case of scenario two as only the beneficiary will have to pay and not the donors.

The best way, however, to go for crowdfunding is through scenario 3. If the crowdfunding is done through an NGO, then all the amount goes directly to the beneficiary. If the NGO has 80G and 12A tax exemption, there will be below benefits attached to it:

1. No taxation for donors and fundraisers since it is done through NGOs.

2. Beneficiaries or recipients will also not pay any tax since NGO transfers the amount.

3. Donors will also be subject to tax savings of up to 50% on their total donations. It will help them reduce their taxable liability.

Laws Around FCRA (Foreign Contribution Regulations Act) Donations

If an individual is planning to raise funds through crowdfunding platforms, they need to ensure they have an FCRA certificate if they wish to raise money from foreign citizens. FCRA is a law that regulates incoming foreign aid or contributions in India.

While fundraising through crowdfunding seems like a good method to help a noble cause, ensure you do not open contributions from outside India. If you wish to do so as a fundraiser, apply for the FCRA certificate to avoid any legal implications during income tax return filing

Final Thoughts

Fundraising through crowdfunding was a concept that started in the West that gained popularity in India. Today, fundraising is done for different purposes, such as helping people in need, stray animals, people fighting a deadly illness, and much more.

If you are willing to contribute, the best way is through a registered NGO with the 80G tax exemption certificate. It will ensure your money goes to the noble cause, and you or the beneficiary are not required to pay taxes.

We use cookies to ensure you get the best experience on our website. Read more...