The market value of the e-commerce industry in India is currently (2021) at $84 billion, expected to grow at an exponential rate to reach $200 billion by 2027.

This data indicates an increase in the potential demand for financial services from more companies keen to leverage the benefits of embedded finance into their business model to provide an enhanced customer experience.

Besides, while traditional businesses facing bottlenecks from non-compliance are slowly embracing digital transformation, start-ups/ digital businesses are keen on implementing innovative financial services embedded into their operations for capturing new and repeat customers.

Therefore, while global brands have started offering banking services, is there much left for Banks and FI's?

Well, there is a lot more to do. Let’s take a sneak peek.

What is Embedded Finance (EF)?

It is simply the integration of financial services into a non-financial business or service.

Some view it as Banking as a service ( BaaS) to create embedded journeys. Like e-commerce where we buy stuff and payment is just simply embedded.

An important aspect that fascinates me about EF is the opportunity to ingrain/plant the complex finance part into a customer’s purchasing experience.

Here is a real-life scenario - For a long time, Mr.Sivasu has been planning to upgrade his 42” smart TV to an ultra HD 50” model. A popular online sale (that has somehow got included in our festival calendar) target markets him with a one-day deal price.

Here comes the win-win deal. A no-cost affordable EMI coupled with a handful of offers to make his desire come true and the entire online shopping exercise offers him a fulfilling customer experience. (Seamless Integration of embedded finance and payments into fulfilling customer experience)

Without a doubt, companies across all sectors, small to big, retailers, e-commerce, tech companies, automotive industry, health care, Insurance providers, logistics, education have started using the benefits of embedded finance to reach their respective consumer segments.

What benefits does EF offer to businesses and financial institutions?

Is embedded finance a competitive advantage or just an IT compliance exercise?

Is embedded finance a competitive advantage or just an IT compliance exercise?

Rationally thinking, it is indeed a competitive advantage for firms and financial institutions.

Moreover, compliance resilience is key to sustainability in response to a changing business climate.

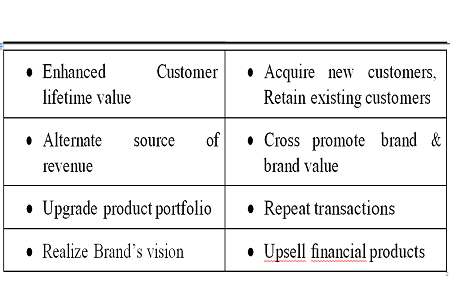

In short, EF o"ers both businesses and financial services a point of intersection to co-create new value chains and integrate seamless value propositions for each other.

Metcalfe’s Law of Connectivity and Reed’s Law - An analogy

Borrowing some thoughts from Robert Melancton Metcalfe’s

Network e"ects. It states that “the value of a telecommunication network is proportional to the square of the number of connected users of the system (n2).”