The Centre on Wednesday allowed up to INR 10,000 crore for completing housing projects stuck for years. This came as a huge relief for the distressed homebuyers awaiting possession of their flats. To provide priority debt financing for the completion of stalled housing projects that are in the affordable and middle-income housing sector, the Union Cabinet has cleared a proposal to set up a 'Special Window' in the form of Alternative Investment Fund (AIF).

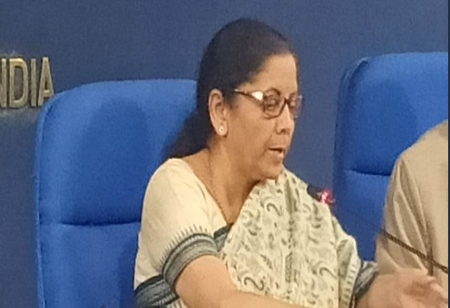

The corpus size of the AIF would be scaled up to INR 25,000 crore after SBI and LIC pump in funds. It would grow further in the coming days with the addition of sovereign wealth funds and pension funds. The AIF would meet fund requirements of 1,600 stalled projects where the money of 4.58 lakh homebuyers are stuck, Finance Minister Nirmala Sitharaman said briefing the media after Cabinet meeting. The Special Window will also cover projects that are classified as NPA or where NCLT proceedings have already started but with the rider that they meet other eligibility criteria.

Some of the conditions for getting the last-mile funding are projects being net-worth positive,

registered with RERA and falling in the category of the affordable and middle-income housing project.

Department of Economic Affairs secretary Atanu Chakraborty said that net-worth positive clause will be applied project-wise taking into account cash flows and total project cost and not at the corporate level. This would mean even projects being undertaken by now-bankrupt Amrapali and Jaypee Group could qualify for funding depending on the completion status. Anticipating realty sector booster from the government, the Indian stock market on Wednesday surged to record levels. It may touch a new peak tomorrow, bolstering realty sector stocks.

Finance Minister Nirmala Sitharaman said that the move would reduce the financial stress faced by a large number of middle-class homebuyers who have invested their hard-earned money. This will also restore trust between buyers and developers and boost the sentiments of the housing sector as a whole and release large amounts of funds stuck in these projects for productive use in the economy. The proposed fund would initially be managed by SBI Caps through an escrow account. It will also be registered with market regulator SEBI and will support all RERA certified projects.

The finance minister in September had announced that a special window for affordable and middle-income housing will be created for providing last-mile funding for housing projects which are stressed. Fund created under the Special Window will be set up as priority debt funds. A detailed Investment Policy will be laid down to guide the selection of projects to be financed through a detailed due-diligence process that will include legal due-diligence, title due diligence, micro-market analysis, financial analysis, etc. The final decision will be taken by the Investment Committee of each fund comprising experienced professionals and industry experts. The Investment Committee will approve individual deals independently as per Investment Policy ensuring alignment with investment objectives of the Fund.

Magazine

Magazine