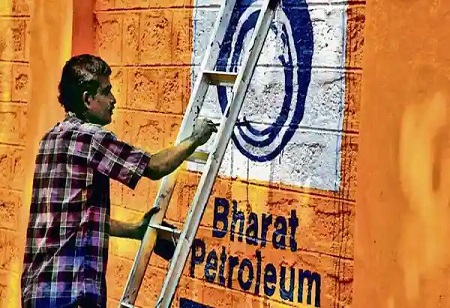

Vedanta Group is willing to spend $12 billion to acquire India’s state-owned refiner Bharat Petroleum Corp., as an asset sale that’s among

the nation’s biggest and which has faced delays in completion.

“We’re not going to bid aggressively, but we will put the right price,” billionaire chairman Anil Agarwal said. The market cap of the company is about $11 billion to $12 billion, so this is the amount of investment we’re looking at.”

India’s plan to privatize BPCL and has run into rough weather with bidders struggling to find partners and spread their financial risks for the big-ticket acquisition. The country was expecting global oil majors to team up with investment funds to participate in the sale despite some bidders are finding it difficult to invest due in fossil fuels.

“We’ve an understanding with people, everyone will be putting the money as the deal comes through,” Agarwal said.